InfoWARE Analyst Daily Market Report (03-Dec-2024 15:07:24.314) | InfoWARE Finance

InfoWARE Analyst Daily Market Report (03-Dec-2024 15:07:24.314)

(Source: InfoWARE Terminal, Date: 03-Dec-2024)

Dear Investor,

InfoWARE Analyst Daily Market Report - 03-Dec-2024 15:07:24.313

The Nigerian equities market recorded another down day, as the NGX All-Share Index (NGXASI) closed the day down by -0.03%,

to bring the Year-to-Date returns up 28.57%.

The All Share Index closed at 97,702.56 against the previous close of 97,733.86, volume traded decreased by -12.76% from 447.84M to 390.72M, while market turnover (the total value of shares traded) decreased by -24.69% from NGN9.82B to NGN7.39B in 8,852.00 deals.

Market breadth (1.42x) signified Forty-four (44) advancers, as against Thirty-one (31) decliners.

Volume was up for 77 companies and down for 78

|

Top ASI Gainers Over Last 5 Trading Days

|

Top ASI Losers Over Last 5 Trading Days

|

For more detailed analysis, on InfoWARE Market Data Terminal <NSEPERF> <GO>

On InfoWARE Finance Mobile App (Android, iPhone & iPad, Windows Phone and Windows 8/10), "Top Gainers & Losers"

BETA GLASS CO PLC. (BETAGLAS) topped the advancers list closing at N53.90 with a gain of 10.00% followed by GOLDEN GUINEA BREW. PLC. (GOLDBREW) which closed at N4.07 with a gain of 10.00%.

On the flip side SOVEREIGN TRUST INSURANCE PLC (SOVRENINS) and JOHN HOLT PLC. (JOHNHOLT) topped the decliners log with a loss of -10.00% at a close of N0.72, and -9.98% to close the day at N8.03 respectively.

| Symbol | LClose | %Chg |

|---|---|---|

| BETAGLAS | 53.90 | 10.00 |

| GOLDBREW | 4.07 | 10.00 |

| WAPCO | 70.15 | 9.95 |

| HONYFLOUR | 4.89 | 9.89 |

| SUNUASSUR | 4.67 | 9.88 |

| Symbol | LClose | %Chg |

|---|---|---|

| SOVRENINS | 0.72 | -10.00 |

| JOHNHOLT | 8.03 | -9.98 |

| ELLAHLAKES | 3.18 | -9.92 |

| THOMASWY | 1.73 | -9.42 |

| ARADEL | 471.90 | -8.72 |

For more detailed analysis,

- On InfoWARE Market Data Terminal <TOPG> <GO>

- On InfoWARE Finance Mobile App ( Android, iPhone & iPad and Windows 10) , "Top Gainers & Losers"

Currency Market

In the currency market, the Naira fell 0.09%(-1.56) against the Dollar to settle at 1 to 1NSE: Bull Signal - Price crossed above 15 Day MA

This signal implies these stocks are under buying pressure and the price might continue to rise and therefore positions should be monitored closely. Further suggested analysis include looking at the overall market (ASI) to see if the uptrend is market wide, sector wide or specific to the stock. Portfolio managers tend to use this as a signal to do more research to add to their positions or lock in some profits. Typically further analysis should be done using commands like PC and RV on the InfoWARE Market Data Terminal. Another command is ALERTS to set price triggers for possible exit or entry as necessary

For more detailed analysis,

- On InfoWARE Market Data Terminal <NSEPERF> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Top Gainers & Losers"

| Symbol | Price | %Chg | 15DMA | PE | EPS | DivY | MktCap | Vol | Trades | Value | LstTradeTime |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HONYFLOUR | 4.89 | 9.00 | 4.62 | 14.49 | 0.31 | 1.57 | 38.78B | 4.57M | 108.00 | 22.27M | 03-Dec-2024 14:30:16.247 |

| IKEJAHOTEL | 8.00 | 6.88 | 7.86 | 48.00 | 0.16 | 1.01 | 16.63B | 1.20M | 51.00 | 9.61M | 03-Dec-2024 14:30:16.270 |

| FGSUK2025S2 | 102.00 | 4.90 | 99.53 | 0.00 | 0.00 | 2.00K | 3.00 | 2.04M | 03-Dec-2024 14:30:50.473 | ||

| REGALINS | 0.48 | 4.17 | 0.47 | 4.35 | 0.11 | 6.52 | 3.20B | 10.25M | 31.00 | 4.77M | 03-Dec-2024 14:30:19.733 |

| FBNH | 26.50 | 3.77 | 26.35 | 10.95 | 2.33 | 1.57 | 951.23B | 22.96M | 342.00 | 607.74M | 03-Dec-2024 14:32:34.667 |

| CWG | 6.15 | 3.25 | 6.01 | 0.00 | 0.00 | 2.69 | 15.53B | 952.26K | 24.00 | 5.85M | 03-Dec-2024 14:30:14.843 |

| CAVERTON | 1.89 | 2.65 | 1.86 | 1.17 | 1.57 | 5.43 | 6.33B | 623.34K | 37.00 | 1.15M | 03-Dec-2024 14:30:14.257 |

| NGXCG | 2,638.37 | 0.82 | 2,633.60 | 443.35 | 327.97 | 0.00 | 0.00 | 212.44M | 4,831.00 | 5.99B | 03-Dec-2024 14:30:52.060 |

| NGXBNK | 1,032.42 | 0.81 | 1,031.43 | 6.10 | 34.65 | 0.00 | 0.00 | 107.65M | 2,308.00 | 2.46B | 03-Dec-2024 14:30:52.037 |

| NGXPENSION | 4,297.94 | 0.48 | 4,291.80 | 429.80 | 359.59 | 0.00 | 0.00 | 216.39M | 5,443.00 | 6.58B | 03-Dec-2024 14:30:52.430 |

| NGX30 | 3,686.11 | 0.33 | 3,677.80 | 575.61 | 329.08 | 0.00 | 0.00 | 175.14M | 4,777.00 | 6.15B | 03-Dec-2024 14:30:51.910 |

NSE: BEAR Signal - Price crossed below 15 Day MA

This signal implies these stocks are under selling pressure and the price might continue to slide and therefore positions should be monitored closely. Further suggested analysis include looking at the overall market (ASI) to see if the downtrend is market wide, sector wide or specific to the stock. If the overal market trend is upwards, then since these stocks are heading in the opposite direction, then further analysis should be done using commands like PC and RV on the InfoWARE Market Data Terminal. Another command is ALERTS to set price triggers for possible exit is necessar

For more detailed analysis,

- On InfoWARE Market Data Terminal <BEARM> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10)

| Symbol | Price | %Chg | 15DMA | PE | EPS | DivY | MktCap | Vol | Trades | Value | LstTradeTime |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASI | 97,702.56 | -0.03 | 97,703.50 | 11.84 | 457.69 | 0.00 | 0.00 | 390.72M | 8,852.00 | 7.39B | 03-Dec-2024 14:30:51.897 |

| NGXMAINBOARD | 4,721.15 | -0.46 | 4,740.89 | 12.90 | 225.05 | 0.00 | 0.00 | 282.40M | 6,309.00 | 3.35B | 03-Dec-2024 14:30:52.263 |

| JAPAULGOLD | 2.19 | -2.28 | 2.23 | 0.19 | 12.01 | 0.89 | 13.72B | 15.15M | 202.00 | 33.47M | 03-Dec-2024 14:30:16.577 |

| INTBREW | 4.00 | -2.50 | 4.01 | 0.00 | 0.00 | 6.10 | 107.45B | 3.05M | 45.00 | 12.30M | 03-Dec-2024 14:30:16.460 |

| UACN | 22.00 | -2.50 | 22.02 | 9.61 | 2.35 | 0.98 | 64.37B | 3.67M | 99.00 | 80.91M | 03-Dec-2024 14:32:25.110 |

| STANBICETF30 | 370.00 | -7.03 | 389.03 | 0.00 | 0.00 | 8.94K | 12.00 | 3.22M | 03-Dec-2024 14:32:29.090 | ||

| THOMASWY | 1.73 | -10.40 | 1.86 | 0.00 | 0.00 | 1.05 | 380.60M | 165.36K | 8.00 | 291.97K | 03-Dec-2024 14:30:20.407 |

| ELLAHLAKES | 3.18 | -11.01 | 3.37 | 0.00 | 0.00 | 0.00 | 6.36B | 23.03M | 181.00 | 76.50M | 03-Dec-2024 14:32:24.607 |

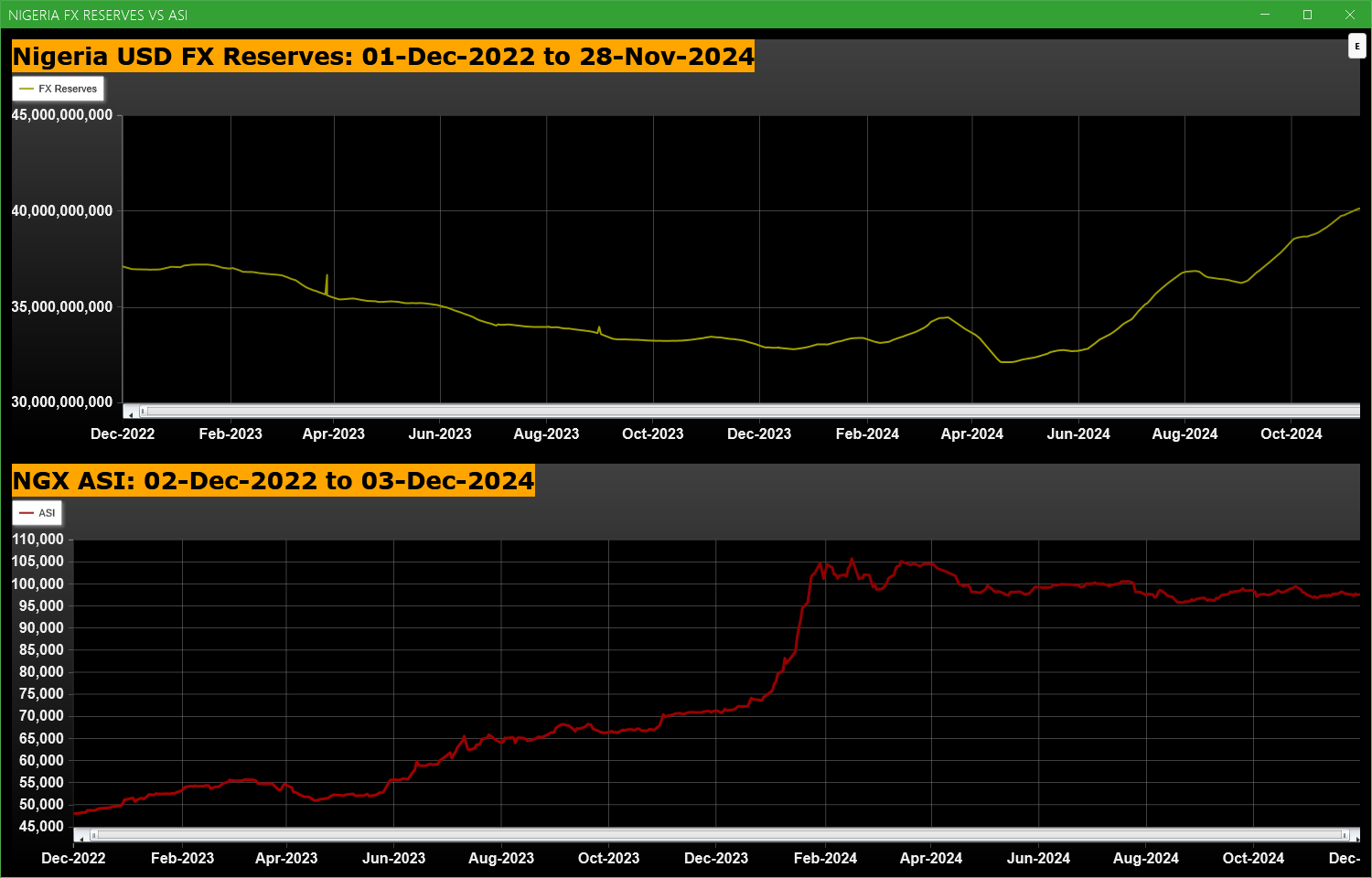

Economic Indicators - Nigeria FX Reserves Vs ASI Chart

Nigeria FX Reserves are assets held on reserve by CBN in foreign currencies. These reserves are used to back liabilities and influence monetary policy. Given the nature of the Nigeria economy, FX Reserves can appear to have an outsize influence on the economy and hence on the capital market. The chart below allows comparison of FX Reserves against the ASI to make investment decisions

For more detailed analysis,

- On InfoWARE Market Data Terminal <CI> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Research"

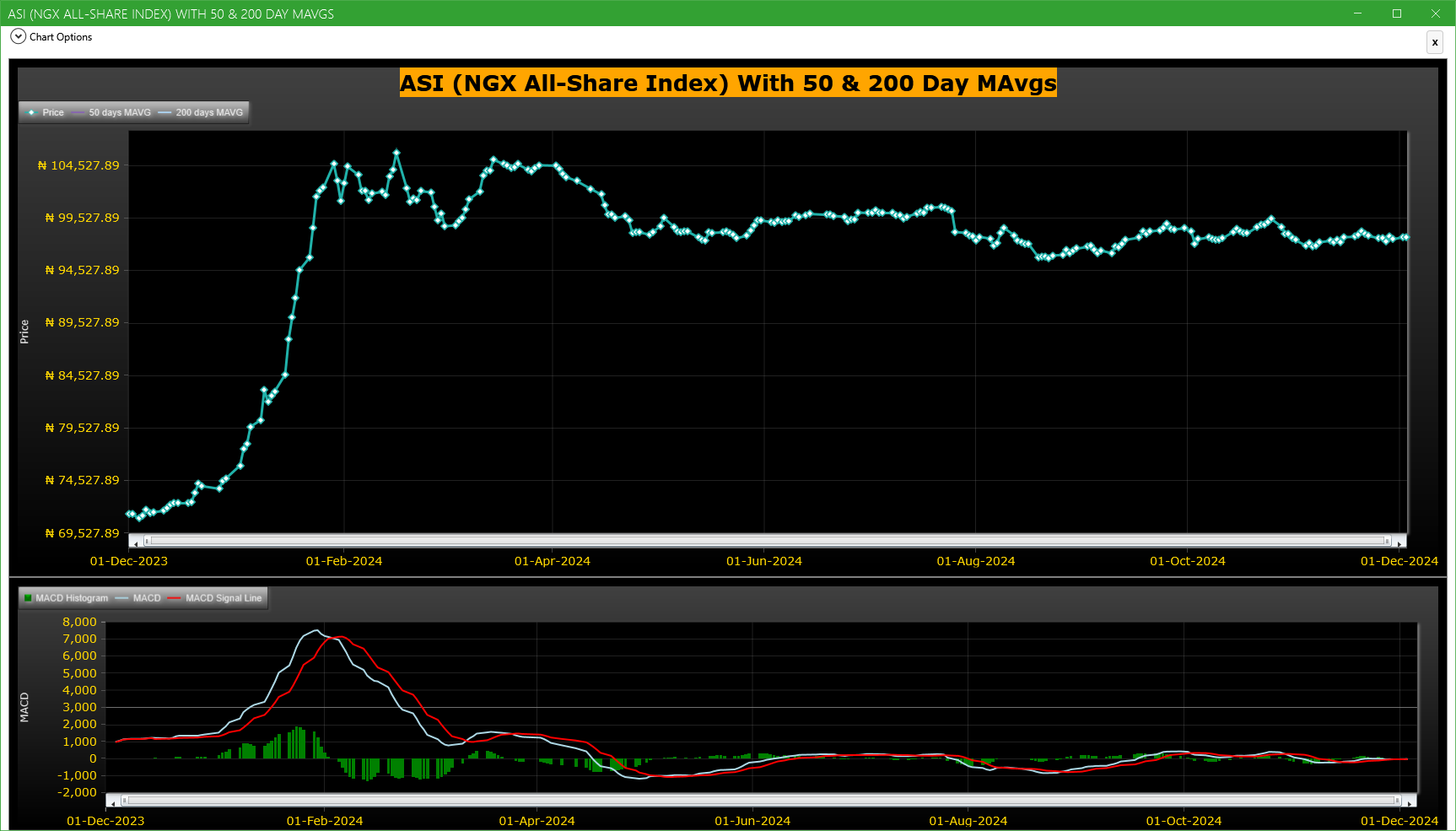

Market Trend - ASI (NGX All-Share-Index) With 50 & 200 Day MAvgs Chart

Technical traders typically use the 50 & 200 day moving averages to aid in choosing

where to enter or exit a position, which then causes these levels to act as strong

support or resistance. As a general guideline, if the price is above a moving average,

the trend is up. If the price is below a moving average, the trend is down.

It is important to note that critics of technical analysis say that moving averages act

as support and resistance because so many traders use these indicators to inform their

trading decisions. Also moving averages tend to work quite well in strong trending conditions

but poorly in choppy or ranging conditions.

Trading Strategies: Crossovers

Crossovers are one of the main moving average strategies. The first type is a price crossover,

which is when the price crosses above or below a moving average to signal a potential change

in trend. Another strategy is to apply two moving averages to a chart: one longer and one

shorter. When the shorter-term MA crosses above the longer-term MA, it is a buy signal, as

it indicates that the trend is shifting up. This is known as a golden cross. Meanwhile, when

the shorter-term MA crosses below the longer-term MA, it is a sell signal, as it indicates that

the trend is shifting down. This is known as a dead/death cross

For more detailed analysis,

- On InfoWARE Market Data Terminal <CI> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Research"

Unusual Volume: Volume traded is more than double the 90 day moving average (All exchanges; ASI & ASem). For more detailed analysis,

- On InfoWARE Market Data Terminal <UV> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10)

| Symbol | Name | Volume | 90DAvgVol | %VolChg | Price | LClose | %Chg | Trades | Value |

|---|---|---|---|---|---|---|---|---|---|

| MANSARD | MANSARD INSURANCE PLC | 32.54M | 4.10M | 693.15 | 7.15 | 7.04 | 1.56 | 101 | 242.84M |

| ELLAHLAKES | ELLAH LAKES PLC. | 23.03M | 8.95M | 157.20 | 3.18 | 3.53 | -9.92 | 181 | 76.50M |

| WAPCO | LAFARGE WAPCO PLC. | 14.16M | 4.43M | 220.05 | 70.15 | 63.80 | 9.95 | 184 | 993.63M |

| REGALINS | REGENCY ALLIANCE INSURANCE COMPANY PLC | 10.25M | 2.31M | 344.73 | 0.48 | 0.46 | 4.35 | 31 | 4.77M |

| SUNUASSUR | SUNU ASSURANCES NIGERIA PLC. | 9.40M | 1.34M | 599.38 | 4.67 | 4.25 | 9.88 | 50 | 43.88M |

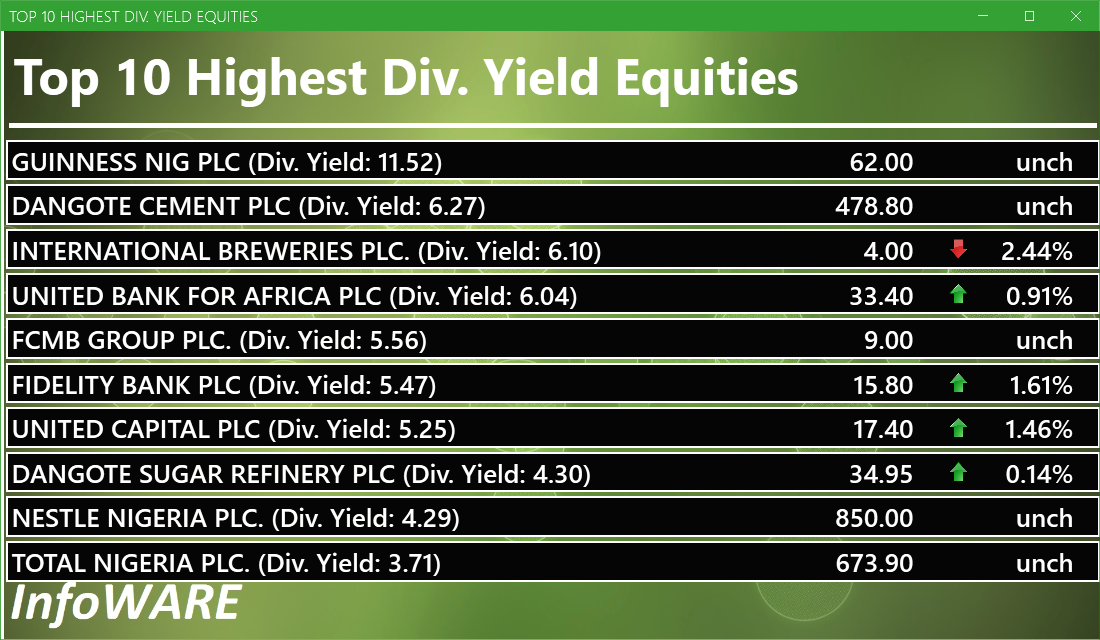

Investment Insights - High Div. Stocks

Dividend stocks distribute a portion of the company earnings to investors on a regular basis and they can a great choice for investors looking for regular income. As an investment or trading strategy, high dividend yield equities provide annual cash payments as against mostly capital gains in the price of a stock. The list in the table below represent the highest dividend paying stocks from the list of the most liquid stocks in the NSE top 30.

For more detailed analysis,

- On InfoWARE Market Data Terminal <HYIELD> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Research"

African Markets

| Name | LClose | Change | %Chg |

|---|---|---|---|

| BRVM Stock Exchange | 273.36 | -1.43 | -0.52 |

| Botswana Stock Exchange | 9,968.72 | 0.00 | 0.00 |

| Egyptian Exchange | 30,525.32 | 27.45 | 0.09 |

| Ghana Stock Exchange | 4,694.37 | 0.00 | 0.00 |

| Johannesburg Stock Exchange | 85,731.50 | 1,217.01 | 1.44 |

| Lusaka Stock Exchange | 15,842.78 | 6.33 | 0.04 |

| Casablanca Stock Exchange | 14,718.91 | -118.70 | -0.80 |

| Malawi Stock Exchange | 163,750.90 | 554.87 | 0.34 |

| Nigeria Stock Exchange | 97,733.86 | 224.27 | 0.23 |

| Nairobi Securities Exchange | 112.74 | 1.20 | 1.08 |

| Namibian Stock Exchange | 1,886.41 | 33.36 | 1.80 |

| Rwanda Stock Exchange | 146.66 | 0.00 | 0.00 |

| Tunis Stock Exchange | 9,874.65 | 8.88 | 0.09 |

| Uganda Securities Exchange | 1,147.77 | 7.53 | 0.66 |

Nigeria Market Indexes

| Symbol | LClose | %Chg | WTD% | MTD% | QTD% | YTD% | MktCap | Trades |

|---|---|---|---|---|---|---|---|---|

| ASI | 97,702.56 | -0.03 | -0.03 | -0.03 | -0.54 | 28.57 | 8,852 | |

| NGX30 | 3,686.11 | 0.33 | 0.33 | 0.33 | 1.05 | 29.84 | 4,777 | |

| NGXAFRBVI | 2,388.97 | 0.42 | 0.42 | 0.42 | 16.22 | 16.21 | 1,842 | |

| NGXAFRHDYI | 14,940.27 | 0.69 | 0.69 | 0.69 | 9.98 | 102.06 | 1,836 | |

| NGXASEM | 1,583.71 | 0.00 | 0.00 | 0.00 | 0.00 | 147.63 | 12 | |

| NGXBNK | 1,032.42 | 0.82 | 0.82 | 0.82 | 11.55 | 15.46 | 2,308 | |

| NGXCG | 2,638.37 | 0.82 | 0.82 | 0.82 | 11.38 | 18.97 | 4,831 | |

| NGXCNSMRGDS | 1,596.64 | -0.23 | -0.23 | -0.23 | 1.00 | 41.88 | 945 | |

| NGXGROWTH | 6,174.81 | -0.01 | -0.01 | -0.01 | 19.70 | 5.10 | 29 | |

| NGXINDUSTR | 3,593.22 | 1.00 | 1.00 | 1.00 | -5.62 | 29.70 | 574 | |

| NGXINS | 511.71 | 2.69 | 2.69 | 2.69 | 17.88 | 57.60 | 738 | |

| NGXLOTUSISLM | 6,328.29 | 1.63 | 1.63 | 1.63 | 4.10 | 35.28 | 955 | |

| NGXMAINBOARD | 4,721.15 | -0.46 | -0.46 | -0.46 | -2.16 | 32.94 | 6,309 | |

| NGXMERIGRW | 6,137.03 | 0.65 | 0.65 | 0.65 | 15.27 | 33.41 | 1,130 | |

| NGXMERIVAL | 9,789.36 | 1.17 | 1.17 | 1.17 | 26.17 | 85.32 | 2,664 | |

| NGXOILGAS | 2,387.93 | -0.09 | -0.09 | -0.09 | 20.10 | 128.11 | 278 | |

| NGXPENBRD | 1,751.15 | 0.37 | 0.37 | 0.37 | 2.36 | 31.64 | 7,001 | |

| NGXPENSION | 4,297.94 | 0.48 | 0.48 | 0.48 | 8.11 | 30.96 | 5,443 | |

| NGXPREMIUM | 9,286.60 | 0.79 | 0.79 | 0.79 | 3.33 | 28.18 | 2,514 | |

| NGXSOVBND | 622.71 | 0.00 | 0.00 | 0.00 | -0.25 | -18.04 | 0 |

For more detailed analysis,

- On InfoWARE Market Data Terminal <MKTINS> <GO>

- On InfoWARE Finance Mobile App ( Android, iPhone & iPad and Windows 10) , "Market Indexes"

Find the topic interesting? Will like to comment? Contact Us at solutions@infowarelimited.com

Top News

Chart Of The Day - ASI Chart Vs ASI Advance Decline Line (YTD) (04-Dec-2024 15:07:29.358)

InfoWARE Analyst Daily Market Report (04-Dec-2024 15:07:24.689)

[CORNERST]>> Earning Forcast - <Q1-2025> ?-<CORNERSTONE INSURANCE PLC>

[VETBANK]>> DAILY INDICATIVE PRICES

[XNSA]>> DAILY FUND PRICE SUBMISSION - FCMB ASSET MANAGEMENT LIMITED

[MERGROWTH]>> DAILY INDICATIVE PRICES

[XNSA]>> NGX FIXED INCOME INDICATIVE PRICE LIST FOR DEC 04, 2024

[XNSA]>> FBC TRUST & SECURITIES LIMITED - APPOINTMENT OF DIRECTORS

[XNSA]>> GLOBAL ASSET MANAGEMENT (NIG) LIMITED - RESIGNATION OF DIRECTOR

[XNSA]>> CORDROS MILESTONE FUNDS' BID & OFFER PRICES

Breaking News! Unusual Volume Alert (04-Dec-2024 10:20:59.485)

Breaking News! Bulls Momentum Alert (04-Dec-2024 10:20:55.225)

Breaking News! Bears Momentum Alert (04-Dec-2024 10:20:55.118)

[GREENWETF]>> DAILY INDICATIVE PRICES

[XNSA]>> INVITATION TO THE 2024 MOA AWARDS CEREMONY

[XNSA]>> UNITED BANK FOR AFRICA PLC: ACTIVATION OF CODE FOR TRADING IN RIGHTS

[XNSA]>> CIS ACADEMY TRAINING ON SECURITIES, INVESTMENT AND FINANCIAL MARKETS

[XNSA]>> BUSINESS CONTINUITY/ DISASTER RECOVERY TEST H2 2024

[AIRTELAFRI]>>Corporate Disclosures-<Airtel Africa Plc>

CSL Nigeria Daily - 03 December 2024

Weekly Update on NT-Bills [23.05% down 76bps] and FGN Bond [19.02% up 5bps]

MARKET PERFORMANCE REPORT & DAILY PRICE LIST

Chart Of The Day - ASI Chart Vs ASI Advance Decline Line (YTD) (03-Dec-2024 15:07:28.906)

InfoWARE Analyst Daily Market Report (03-Dec-2024 15:07:24.314)

[XNSA]>> CORDROS MILESTONE FUNDS' BID & OFFER PRICES

[VSPBONDETF]>> DAILY INDICATIVE PRICES

[XNSA]>> NGX FIXED INCOME INDICATIVE PRICE LIST FOR DEC 03, 2024

[LOTUSHAL15]>> DAILY INDICATIVE PRICES

[MERGROWTH]>> DAILY INDICATIVE PRICES

[XNSA]>> NGX DERIVATIVES WEBINAR - DECEMBER 3, 2024 - 10:00am